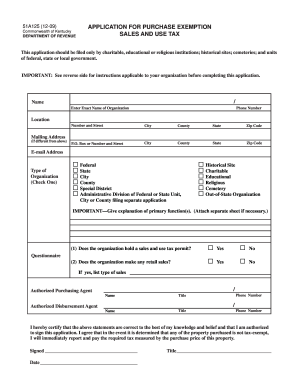

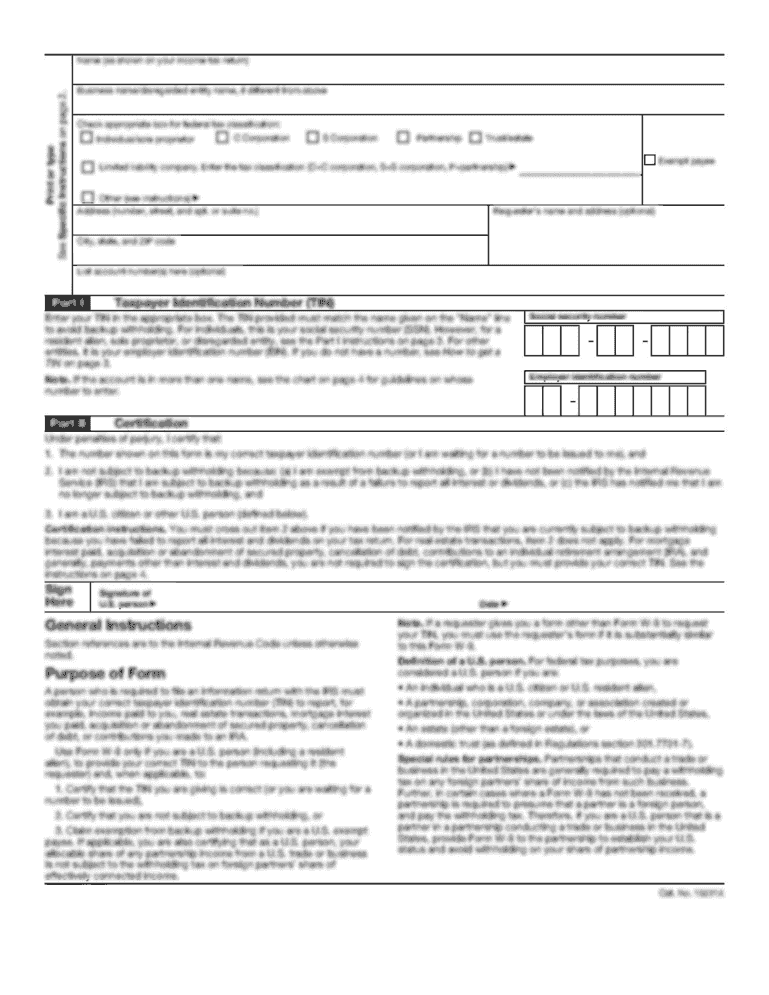

KY 51A125 2017-2024 free printable template

Get, Create, Make and Sign

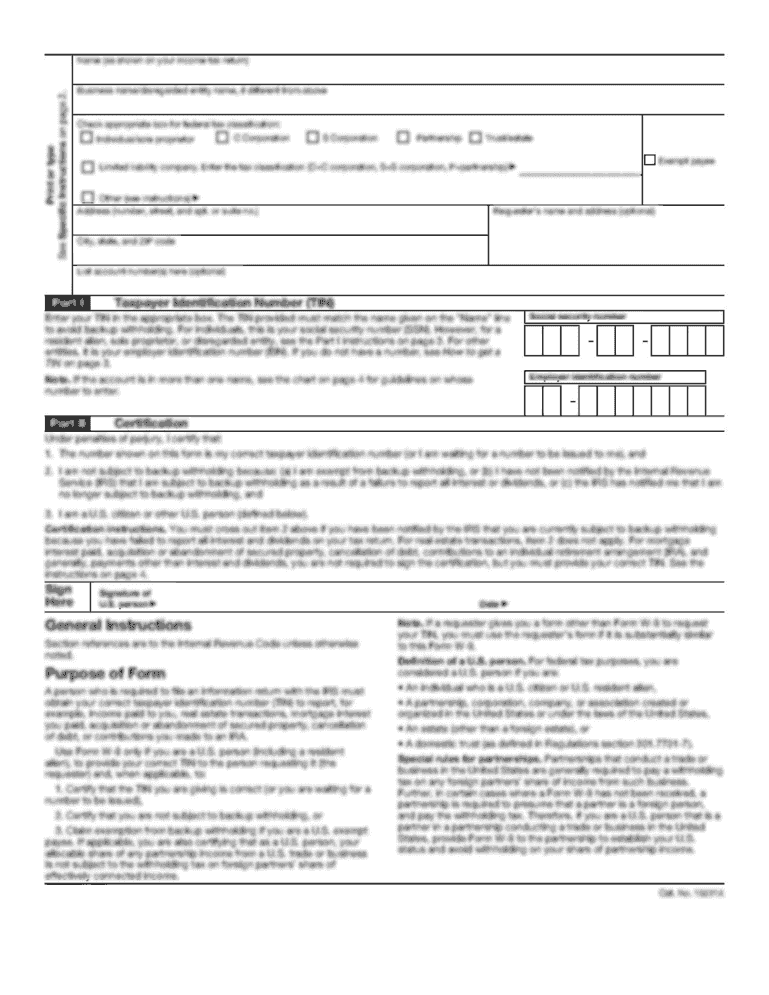

Editing kentucky 51a125 form online

KY 51A125 Form Versions

How to fill out kentucky 51a125 form 2017-2024

How to fill out Kentucky sales tax exemption:

Who needs Kentucky sales tax exemption:

Video instructions and help with filling out and completing kentucky 51a125 form

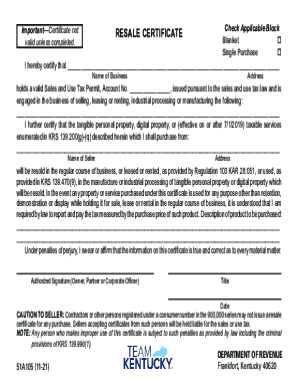

Instructions and Help about kentucky sales tax exemptions form

What's going on everybody at Anushka Chevy here in this video I have something very special for you, I'm going to cover a question that comes up seriously like all the freaking time is how to get tax-exempt on Walmart okay so how can we make more money with our Amazon business step-by-step and if you stick around to the end of the video I'm going to give you a golden nugget because a lot of people have issues with Walmart specifically canceling orders especially on a newer account a newer tax-exempt account, so I'll give you a golden nugget on how to get past canceled orders on Walmart okay so stick around to the end, and we'll break this down very clearly okay, and I got to be open and honest about these guys I am NOT a tax professional in any way I am just a guy that got tax-exempt on Walmart, and it has worked wonders for me, and it's how allowed me to make more profit with my business and I will teach you how I did it from my experience but in no way is this like tax advice or professional advice if you want professional advice please go seek professional advice I highly suggest that because the last thing I want is for this to come back and bite you in the ass because this is really advanced stuff and if you mess with the government as you know they will not they won't play that game, so please understand this is my personal experience this is just what I did and if you want professional advice please they'll speak to a professional tax advisor accountant somebody that can help you understand all the intricacies of this okay because like for example I'm in California you might be in South Dakota or I don't even know where you are but based on where you are your specific situation there are so many variables that will change this okay, so please speak to a pro now for my experience what the heck is talking the tax exemption why would you want to do it and how can we get it done step-by-step, so first tax exemption is a way for businesses to kind of hand down the tax to the customer because in the US the final consumer of a product the person that uses the product needs to pay the tax on that item or should pay the tax on that item okay so if you go into Walmart right now, and you buy a 20 item they're going to say okay 20 plus whatever tax percentage they need to add and let's say California it's nearly 10 so 20 will become 22 that tax will be paid to Walmart will then take that 2 and at some point maybe at the end of the month at the end of three months at the end of the year probably every month there remitting taxes they will pay that 2 to the US government okay the government then gets their money, and they're happy if they don't get that money they don't get that tax they are wondering what the hell's going on okay so what we're trying to do a tax exemption here is we're gonna hand down those taxes to our customers because when we go to Walmart and purchase let's say we purchase 20 item it now becomes 22 that is 10 of our profit that...

Fill tax exemption : Try Risk Free

People Also Ask about kentucky 51a125 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your kentucky 51a125 form 2017-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.