KY 51A125 2017-2026 free printable template

Show details

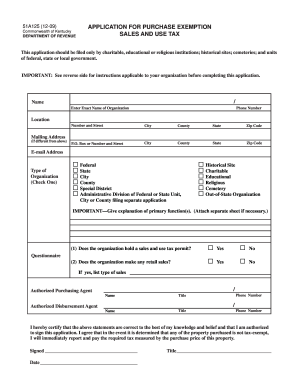

51A125 12-09 Commonwealth of Kentucky DEPARTMENT OF REVENUE APPLICATION FOR PURCHASE EXEMPTION SALES AND USE TAX This application should be led only by charitable educational or religious institutions historical sites cemeteries and units of federal state or local government.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign kentucky sales tax exemption form

Edit your ky form 51a125 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for purchase exemption kentucky form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ky tax exempt form fillable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit kentucky sales tax exemption certificate form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 51A125 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kentucky tax exempt form

How to fill out KY 51A125

01

Obtain the KY 51A125 form from the official Kentucky Department of Revenue website or a local office.

02

Fill in your personal information in the designated fields, including your name, address, and Social Security number.

03

Provide details about your tax situation, including income sources and deductions.

04

Attach any required documentation, such as W-2 forms and other tax-related documents.

05

Review the completed form for accuracy and make sure all required sections are filled.

06

Sign and date the form where indicated.

07

Submit the form by mailing it to the address specified on the form or by using an electronic filing method if applicable.

Who needs KY 51A125?

01

Individuals or businesses in Kentucky who are required to file their tax returns.

02

Taxpayers seeking to claim specific deductions or credits available in Kentucky.

03

Those needing to report their income for state taxation purposes.

Fill

kentucky tax exempt form 2025

: Try Risk Free

People Also Ask about tax exempt form ky

What types of goods are generally exempt from a sales tax?

ingly, most states offer product-specific exemptions for items such as food, clothing, prescription medicines, and medical (prosthetic) devices. Those states that don't provide a complete exemption for these items often impose a lower tax rate on them. Exemptions based on type of purchaser.

What are Kentucky sales tax exceptions?

In Kentucky, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several exceptions to the state sales tax are goods and machinery which will be sold to farmers, any machinery which is intended for new and expanded industries, any oil and gas extraction machinery.

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

What is the sales tax rule in Kentucky?

Kentucky's sales and use tax rate is six percent (6%). Kentucky does not have additional sales taxes imposed by a city or county.

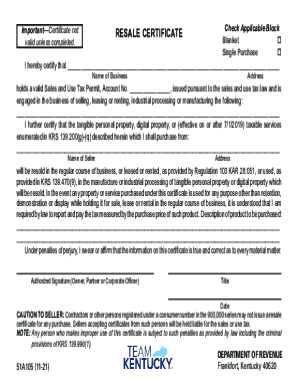

What is the out of state sales tax exemption form for Kentucky?

The Out-Of-State Exemption Certificate, Revenue form 51A127, must be provided to sellers to substantiate the exempt status of each purchase in this state. Purchases derived from lodgings, meals, materials, and equipment are all eligible for the above exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ky sales tax exempt form in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your tax exempt form kentucky as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit ky sales tax exemption form straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit kentucky sales tax exempt form.

Can I edit purchase exemption certificate on an Android device?

With the pdfFiller Android app, you can edit, sign, and share ky purchase exemption on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is KY 51A125?

KY 51A125 is a tax form used in Kentucky for reporting income tax withheld by employers from employees' wages.

Who is required to file KY 51A125?

Employers who withhold Kentucky state income tax from their employees' compensation are required to file the KY 51A125 form.

How to fill out KY 51A125?

To fill out KY 51A125, employers need to enter the total amount of wages paid, the total tax withheld, and other required information as specified in the instruction booklet that accompanies the form.

What is the purpose of KY 51A125?

The purpose of KY 51A125 is to report the amount of state income tax that has been withheld from employee wages to the Kentucky Department of Revenue.

What information must be reported on KY 51A125?

The information that must be reported on KY 51A125 includes the employer's identification number, the total wages paid, total tax withheld, and any adjustments or corrections from previous filings.

Fill out your KY 51A125 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ky Tax Exempt Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to kentucky resale certificate

Related to kentucky sales tax exemption certificate pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.